Related searches

Small Business Start Up Grants

Apply For Small Business Grants

Government Small Business Grants

State Small Business Grants

Small Business Development Grants

Small Business Funding Grants

Apply for Small Business Grants

Navigating the world of small business grants can seem daunting, but it doesn’t have to be. There are many federal, state, and local programs designed to support entrepreneurs. Whether you’re launching a startup or seeking to expand, the key is to apply for small business grants that align with your goals.

Small Business Start-Up Grants

If you're just getting started, small business start-up grants can provide the seed money you need to take your ideas off the ground. These grants are specifically designed for new entrepreneurs who are committed to creating innovative solutions. With the right grant, you can secure the capital to hire staff, invest in equipment, or market your new business.

Small Business Development Grants

For those looking to scale their business, small business development grants offer essential support. These grants focus on helping existing businesses expand operations, improve processes, or innovate new products. Whether you’re a tech startup or a local service provider, development grants can give you the edge to outpace your competition.

Small Business Funding Grants

Beyond startups and development, small business funding grants provide essential financial support across various industries. From retail to healthcare, these grants can cover operating costs, research, and more, empowering your business to thrive in competitive markets.

State Small Business Grants

Each state offers unique grant opportunities to encourage business growth in their region. State small business grants are tailored to local needs, offering additional funding to boost regional industries. Whether you’re based in California, Texas, or any other state, these grants can be a critical component in your growth strategy.

Take the Next Step

Securing a government grant can make all the difference in your small business journey. It’s time to apply for small business grants and unlock your potential. With the right funding, your business can grow faster, innovate better, and create lasting success.

Start today—explore available grants and fuel your business growth!

The Best Credit Cards For Bad Credit In PeloponnesePoor credit no longer prevents you from obtaining a respectable credit card. A variety of cards that cater specifically to individuals with credit challenges burst onto the scene in 2024.

The Best Credit Cards For Bad Credit In PeloponnesePoor credit no longer prevents you from obtaining a respectable credit card. A variety of cards that cater specifically to individuals with credit challenges burst onto the scene in 2024. The Power of Mortgage LoansIn the journey towards homeownership, mortgage loans serve as the key that unlocks the door to your dream home, providing the financial means to turn aspirations into reality. Let's delve into the world of mortgage loans and discover how they empower individuals and families to achieve their homeownership goals with confidence and ease.

The Power of Mortgage LoansIn the journey towards homeownership, mortgage loans serve as the key that unlocks the door to your dream home, providing the financial means to turn aspirations into reality. Let's delve into the world of mortgage loans and discover how they empower individuals and families to achieve their homeownership goals with confidence and ease. Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

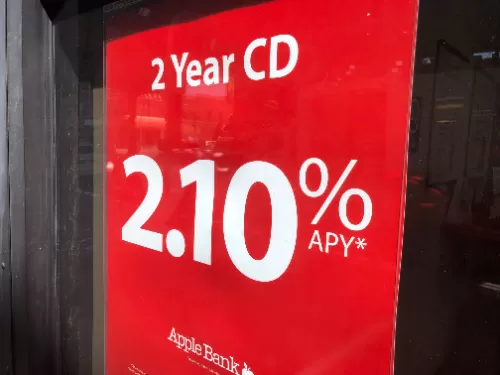

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Business Security: 7 Essential Steps to Protect Your Business in 2025In today’s rapidly evolving business landscape, business security systems are no longer just an option—they’re a critical necessity. Whether you run a small startup or a large corporation, protecting your assets, employees, and data from theft, vandalism, and other risks should be a top priority. As crime rates fluctuate and technology evolves, the demand for business security monitoring has skyrocketed. Business owners are increasingly searching for business alarm companies to install effective security systems for business that can provide peace of mind and reliable protection.

Business Security: 7 Essential Steps to Protect Your Business in 2025In today’s rapidly evolving business landscape, business security systems are no longer just an option—they’re a critical necessity. Whether you run a small startup or a large corporation, protecting your assets, employees, and data from theft, vandalism, and other risks should be a top priority. As crime rates fluctuate and technology evolves, the demand for business security monitoring has skyrocketed. Business owners are increasingly searching for business alarm companies to install effective security systems for business that can provide peace of mind and reliable protection. Your Complete Guide to Book Publishing in 2025: From Manuscript to MarketplaceToday's publishing landscape offers authors more options than ever before. With traditional publishing houses, hybrid models, and self-publishing platforms all vying for attention, understanding book publishing services is crucial for any aspiring author looking to publish your book successfully.

Your Complete Guide to Book Publishing in 2025: From Manuscript to MarketplaceToday's publishing landscape offers authors more options than ever before. With traditional publishing houses, hybrid models, and self-publishing platforms all vying for attention, understanding book publishing services is crucial for any aspiring author looking to publish your book successfully. The Future of Finance: Embrace the Power of Digital WalletsIn today’s fast-paced world, digital payments and digital wallets have revolutionized the way we handle money. From paying bills to making purchases with a single tap, digital wallets offer convenience, security, and speed. Here’s a closer look at why digital payments are transforming everyday transactions and how you can benefit from the latest digital wallet options.

The Future of Finance: Embrace the Power of Digital WalletsIn today’s fast-paced world, digital payments and digital wallets have revolutionized the way we handle money. From paying bills to making purchases with a single tap, digital wallets offer convenience, security, and speed. Here’s a closer look at why digital payments are transforming everyday transactions and how you can benefit from the latest digital wallet options. Unlock Your Potential: Apply for Government Small Business Grants TodayStarting or expanding a small business can be a challenging journey, but government small business grants offer an incredible opportunity to fuel your dreams. These grants provide a financial boost without the burden of repayment, allowing you to focus on growing your business. In this guide, we’ll explore various options and how you can secure the funding you need.

Unlock Your Potential: Apply for Government Small Business Grants TodayStarting or expanding a small business can be a challenging journey, but government small business grants offer an incredible opportunity to fuel your dreams. These grants provide a financial boost without the burden of repayment, allowing you to focus on growing your business. In this guide, we’ll explore various options and how you can secure the funding you need.